Muhammad Zamir Assadi

BEIJING : If now you walked into a Walmart in San Leandro or a Costco in Seattle right now, what would you see?

“I’m forcing myself not to pay too much attention to recent prices, especially for beef and coffee,” said Cessy, a homemaker, as she put a bag of vacuum-packed flat iron steak into shopping cart. “It was $9.84 per libra before, now it’s $11.84. What’s next? I have no idea.”

Unbeknownst to Cessy, data from the U.S. Department of Agriculture shows that the average domestic steak price is currently approximately 8% higher than the same period last year. Following eggs, US consumers will also be facing rising beef prices due to factors such as tariffs.

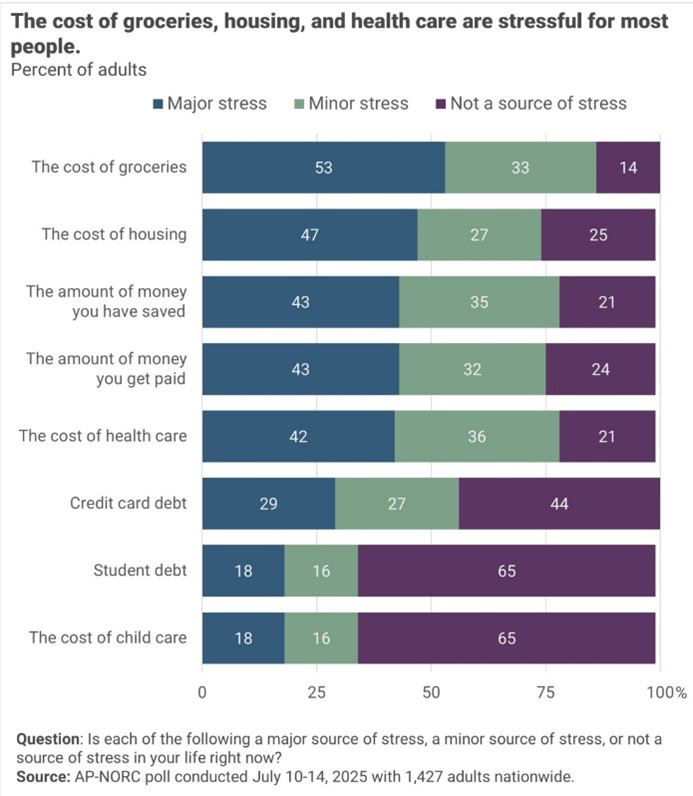

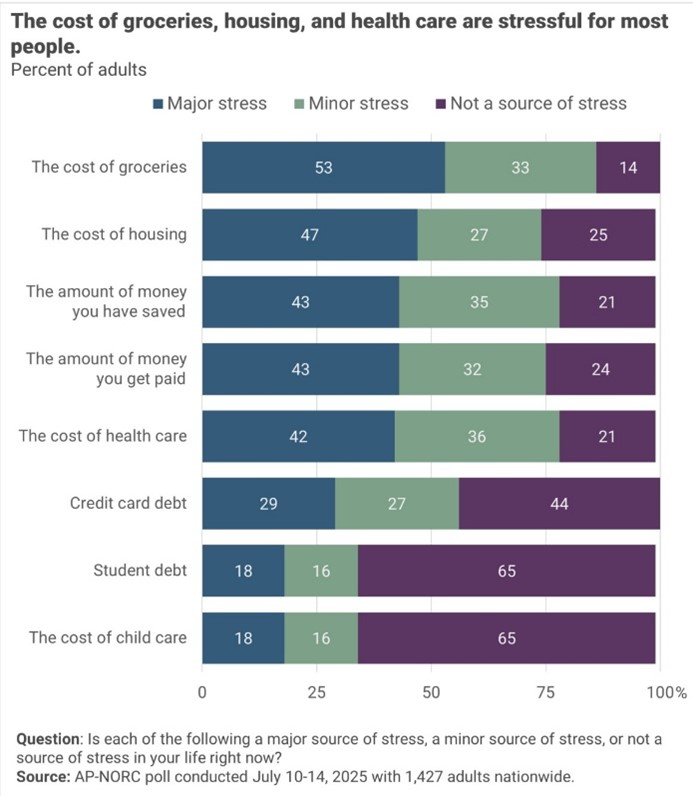

The US government’s consumer price index for June, released on July 15, showed the largest year-on-year increase since February. A new poll from the Associated Press-NORC Center for Public Affairs Research shows that about half of respondents said that grocery prices are a “major” factor causing stress in their lives right now. That percentage rises to 64% among those whose households earn less than $30,000 a year. Clearly, Trump’s tariff policy is beginning to weigh on the American people.

Dusty Kenney, an American children’s products dealer, introduced her products to the reporter. “We sell baby spoons, placemats, lunch boxes, cups and plates, all of which are made in China and then shipped to the United States by sea. To be honest, I also hope to produce all of stuff in the United States, but the fact is that the necessary manufacturing infrastructure is lacking here. Of course, I have also considered opening a production base in my country, but the complexity of this plan is far beyond my imagination and budget.”

“A small business with just over a dozen employees definitely can’t afford triple costs. Earlier, I seized the opportunity to stockpile about three months’ inventory, but will prices increase? I’m sorry but yes, if the tariff policy continues.”

A report from the American Toy Association shows that 80% of the nation’s toys are produced in China. After Trump’s new tariffs on China took effect, the cost of imported plastic raw materials surged 34%. A Lego set originally priced at $29.99 is now priced at $32.99. Jessica, mother of a 12-year-old girl, couldn’t help but smile wryly as she checked out, “My child’s birthday present also has to be paid in installments.”

On July 31, U.S. President Donald Trump signed an executive order that modified “reciprocal” tariffs on dozens of countries, with updated duties ranging from 10% to 41%.

According to the latest estimates from the Yale Budget Lab, if all U.S. tariffs implemented as of July 31, the impact of foreign reciprocal countermeasures, and the so-called “reciprocal tariffs” that took effect on August 7 are taken into account, the series of tariff barriers announced by the Trump administration will bring the average U.S. tariff rate to 17.3%, the highest level since 1935.

Faced with the impending cost shock, American companies are responding. On the 29th, local time, Procter & Gamble released a pessimistic outlook for 2025 and notified major retailers, including Walmart, that it would raise prices on some products starting next week. P&G said it would raise prices by approximately 5% on approximately a quarter of its products in the US market to offset the cost pressures of the new round of tariffs.

In addition, Amazon has raised prices on low-cost items such as deodorant, protein shakes and pet care products. Since the Trump administration announced the so-called “Liberation Day tariffs” in April, uncertainty surrounding tariff policies has continued to loom over American businesses, particularly small and medium-sized enterprises (SMEs) that rely on imports. According to the US Department of Commerce, over 90% of US importers are small and medium-sized enterprises (SMEs), which have limited.

ability to pass on tariff costs. Consumer giants are generally under pressure in the capital markets. Since the announcement of the “Liberation Day” tariffs, Procter & Gamble’s stock price has fallen 19%, Nestle’s 20%, Kimberly-Clark’s 11%, and PepsiCo’s nearly 7%.

Who picks up the bill?

In reality, everyone pays.

Tariffs are typically paid at the border, by the importer of the product affected. Every company at every stage of the supply chain will literally try to pass the buck, as much as possible.

And the very end of the chain, economists expect prices will ultimately rise for consumers. The Budget Lab at Yale estimates the short-term impact of Trump’s tariffs so far is a 1.8% rise in US prices: equivalent to an average income loss of $2,400 per US household. In the short term, consumers could see a 40% increase in footwear prices and a 38% increase in apparel prices, while in the long term, footwear prices could rise by 19% and apparel prices by 17%.

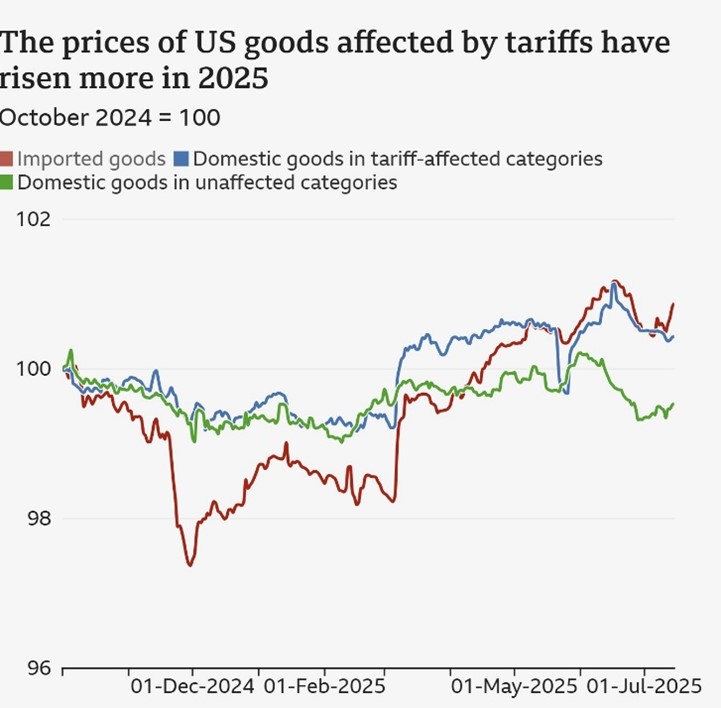

Stockpiling in the earlier part of the year has helped retailers absorb the impact of the tariffs without needing to raise retail prices. However, economists saw in the latest official data some signs that Trump’s tariffs are now starting to feed through to US consumer prices. It’s not hard to find that the price of imported goods into the US and domestic products affected by tariffs have been rising more rapidly in 2025 than domestic goods that are not affected by tariffs.

The US magazine Fortune recently quoted a research report from Morgan Stanley, saying that the US government is expected to impose tariffs of up to $2.7 trillion in the next 10 years, and all of this money will be paid by domestic consumers.

Data jointly released by CNBC and the National Retail Federation (NRF) showed that, driven by consumer concerns, total and core retail sales in the United States fell by 0.33% and 0.32%, respectively, in June. Downward revisions to these figures are possible. Because companies struggle to accurately calculate costs and benefits and cannot predict future tax rate fluctuations, investment intentions among US companies have been significantly dampened. This uncertainty also complicates adjustments to their global supply chain layouts.

In terms of gross domestic product (GDP), calculations by the Yale Budget Lab show that in 2025 and 2026, the US real GDP growth rate will be reduced by 0.5 percentage points each year due to the impact of all tariffs in 2025. In the long run, the US economy will continue to shrink by 0.4%.