Global trade to hit record $35tn—by routing around Washington

Global trade is on track to reach a historic milestone of $35 trillion in 2025, surging 7% year-over-year in one of the strongest expansions in recent history, according to the latest data from UN Trade and Development (UNCTAD).

Yet, beneath this headline figure lies a striking reorganisation: Global South nations are driving trade to record highs even as the US stagnates. The data reveals a new economic reality where the world’s largest economy, while still vital, is becoming less central to the network it once defined. Developing economies are trading primarily with each other, building networks designed for resilience. Simultaneously, traditional US allies are broadening their partnerships to adapt to a changing landscape.

These parallel movements signal a structural shift: global commerce is evolving towards a multipolar model, with new growth engines emerging alongside American markets.

The US Trade Stagnation

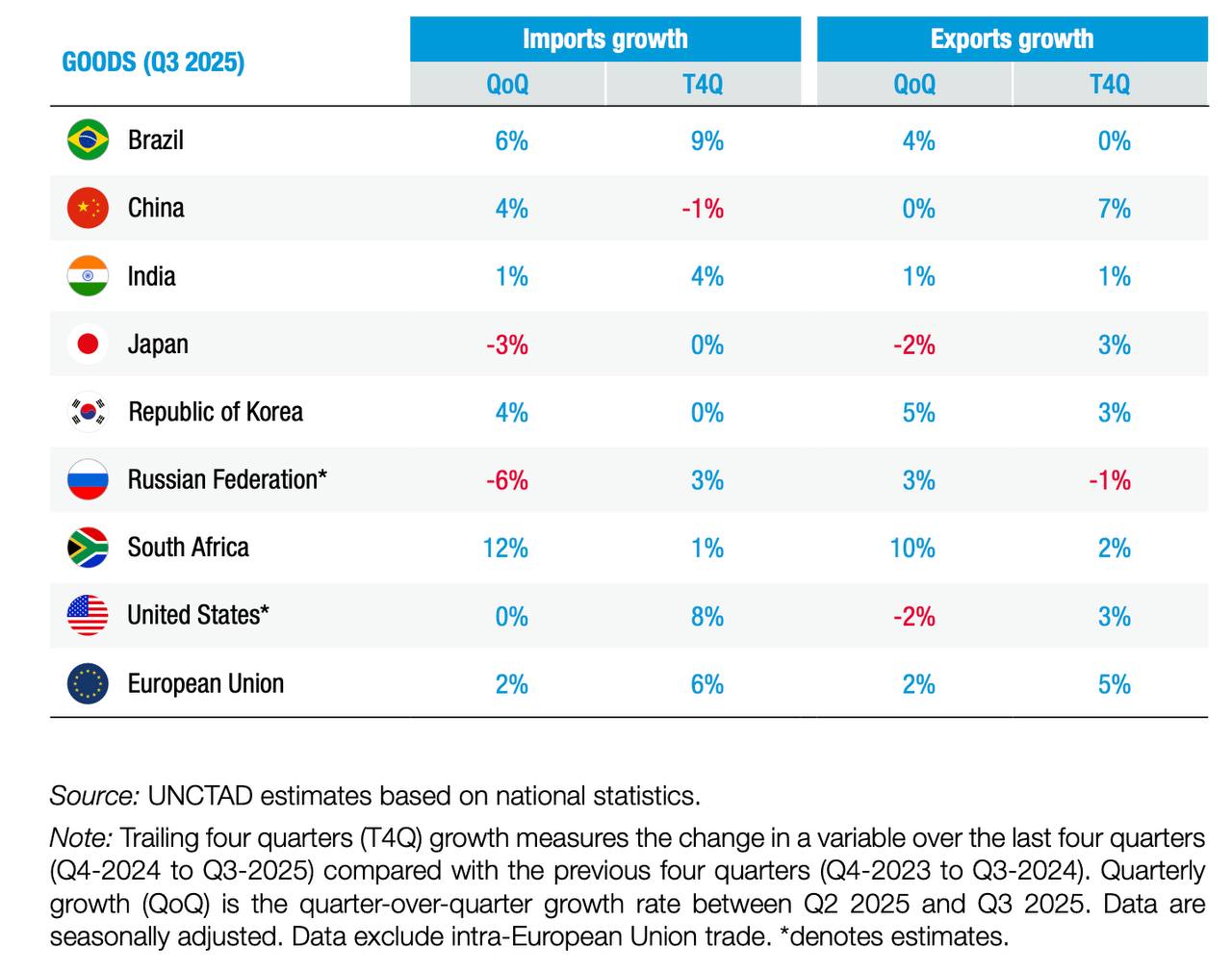

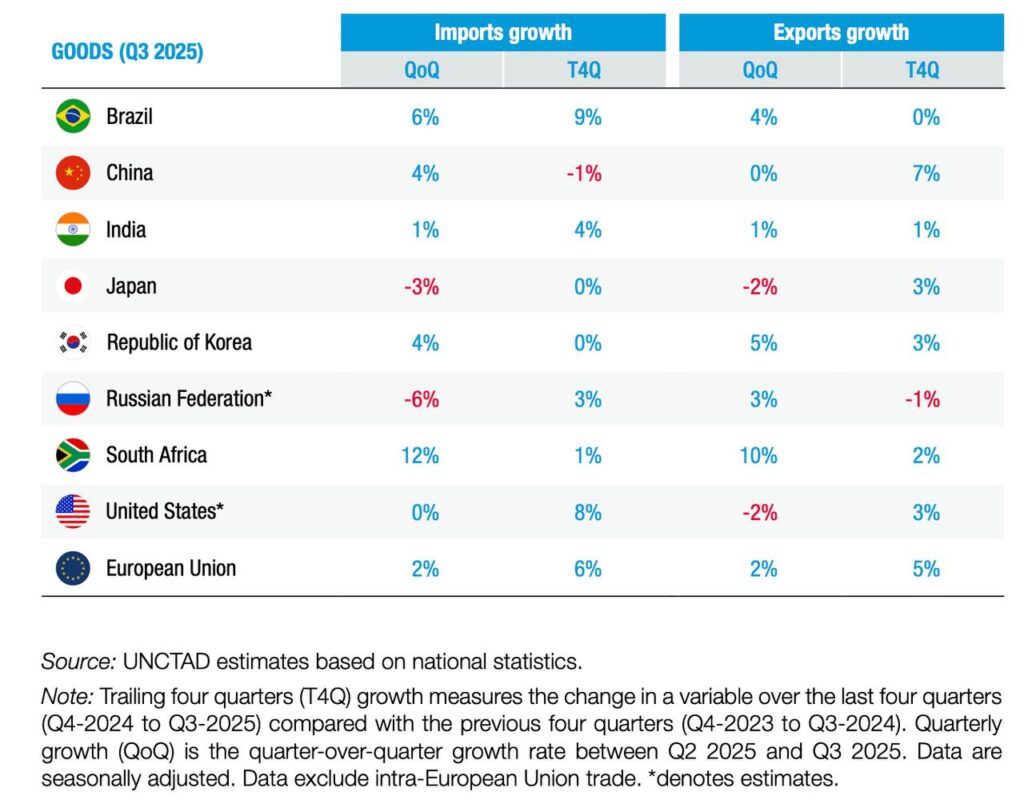

While global trade surges towards $35 trillion, the United States finds itself on the sidelines of this historic expansion, the UNCTAD report indicates. In the third quarter of 2025, the U.S. was a notable outlier among major economies, recording a 2% contraction in goods exports and zero growth in imports quarter-on-quarter. This stands in sharp contrast to the broader global trend, where trade in goods expanded by nearly 2% during the same period.

The stagnation is most evident in U.S. imports, which estimatedly flatlined at 0% in Q3. Although the country saw an 8% expansion over the trailing four quarters through Q3, the upstick is artificial. U.S. companies were “front-loading” inventory ahead of anticipated tariffs rather than responding to genuine demand, as the WTO noted in its October forecast. By the third quarter, this stockpiling had ceased, and the underlying weakness became apparent.

On the goods export side, the WTO projects North American export volumes will decline 3.1% in 2025. This contraction is heavily influenced by specific sectors: UNCTAD data highlights a sharp decline in fossil fuel trade due to falling prices and a continued slump in the automotive sector.

Yet, even as the American engine sputters, global commerce hasn’t stalled—it has simply been turbocharged by alternative players.

The Global South: A New Engine of Growth

Trade between developing economies—or South-South trade—has emerged as the primary engine of global growth. According to UNCTAD’s latest update, South-South trade has surged 8% over the past four quarters, signalling deeper economic ties among developing nations. This momentum is most visible in East Asia, which recorded 9% export growth over the same period, powered by a 10% surge in intra-regional trade—the fastest expansion of any global region.

This acceleration continues a decades-long trajectory. South-South trade has grown three times faster than the global average since 1995, expanding from $600 billion to $5.6 trillion in 2023, according to the UN Office for South-South Cooperation (UNOSSC). A 2023 Brookings calculation notes that trade between Global South countries now accounts for 35% of global commerce, surpassing North-North trade flows.

This realignment reflects deeper structural power. The Global South now generates more than 40% of world output, accounts for nearly half of global merchandise trade, and attracts more than half of global investment inflows. This economic heft means developing economies are less dependent on any single market. They are building diversified trade networks designed for mutual resilience.

Three corridors illustrate how this integration is playing out:

● China-Africa: Bilateral trade reached $295.6 billion in 2024 and surged another 15.4% in the first eight months of 2025. This relationship has evolved beyond simple commodities, with Chinese manufacturing facilities across the continent creating supply chains oriented towards mutual growth.

● ASEAN-GCC: This corridor reached $130.7 billion in 2024 and is projected to hit $180 billion by 2032. The partnership leverages Gulf capital to finance Southeast Asian infrastructure while ASEAN exports flow to Middle Eastern markets.

● Asia-Latin America: Anchored by China’s $518.47 billion in bilateral trade, this corridor marks a strategic shift away from reliance on the US. Growing Asian investment in Latin American manufacturing is creating supply chains designed for global access, fundamentally reshaping the hemisphere’s economic orientation.

Even Allies Are Seeking Diversification

The shift is not solely a Global South phenomenon. America’s closest trading partners are actively constructing broader networks to ensure economic stability amidst global shifts.

Canada’s export dependence on the United States decreased by 0.8% over the trailing four quarters—a subtle but significant diversification for what was once North America’s most integrated bilateral relationship. In March 2025 alone, while Canadian exports to the US fell 6.6%, shipments to non-US markets surged 24.8%. Similarly, Mexican manufacturers are increasingly exploring Asian and European partnerships alongside their USMCA commitments.

Latin American and Caribbean regional exports are projected to grow 5% in 2025, driven increasingly by intra-regional flows rather than northbound shipments. This formalises ECLAC’s explicit recommendation for the region to “deepen trade relations with partners such as China, the European Union, India, ASEAN, and the GCC.”

Even within “friendshoring”—Washington’s strategy to consolidate supply chains among political allies—patterns are evolving. Tade between politically aligned countries remains high, but specific partners are using this stability to hedge. For instance, while relying on the US for security, partners like Canada are economically rebalancing. This does not necessarily signal an exit from the US market, but rather a prudent strategy to distribute risk across a more diversified portfolio of partners.

A Multi-Polar World

UNCTAD explicitly cites “persisting uncertainty in United States trade policy” as a factor in its 2026 growth forecasts. The organisation warns that “geopolitical fragmentation” and “rising trade costs”—largely induced by tariff volatility—threaten to slow momentum.

The result is a global trading system reorganising around multiple poles of activity. Global South networks and allied diversification are adaptations to a more complex global landscape. When barriers rose in one corridor, global commerce found alternative pathways, driving the $35 trillion milestone through distributed growth.

This offers yet another case to what some analysts have termed “de-Americanisation”. As global commerce expands, the US remains a significant power, but it is no longer the sole gravitational force it once was.

The writer is associated with School of Public Policy and Management in Tsinghua University, Beijing, China and may be connected at zamirasadi@gmail.com

Muhammad Zamir Assadi